Silicon Valley Bank (SVB) went down in history as the largest bank run to date. Within 24 hours the bank collapsed.

To put that in context, Washington Mutual Bank, the previous largest bank run in US history, happened over 10 days in 2008.

SVB catered to a particular niche of clients; tech startups. Other financial institutions would consider these “high risk” and tend to stay away from them.

During the pandemic, the tech industry saw a massive increase in demand for technology products and services. At the same time, factors like mass employee lay-offs and increasing remote work pushed startups to ask for more loans to grow and cater to that demand.

Yet, despite being the 16th largest US bank and the preferred choice for the most successful VC-backed tech startups, SVB went down at lightning speed.

In retrospect, as the bank was insolvent throughout January 2023, probably nothing could have prevented its collapse. But still, we asked ourselves a daring question: could SVB have avoided this disastrous bank run?

As our analytical team found out, the mightiest storm indeed starts with a butterfly’s flap…

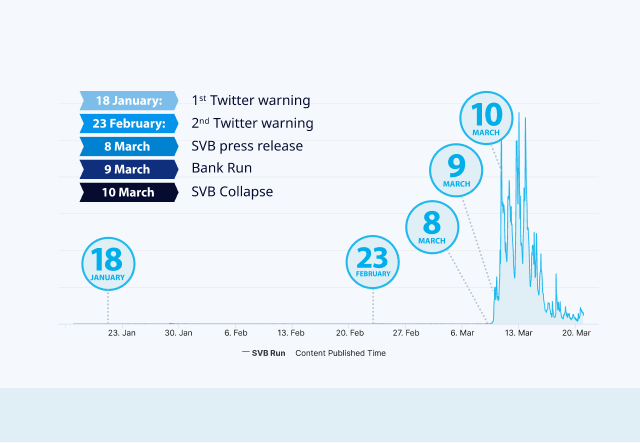

We placed all relevant main events on a timeline and overlaid them with the daily volume of SVB-related tweets for the same period. The correlation instantly hinted towards a possible culprit – It seems that a couple of viral tweets could have set the stage and unleashed the fastest bank failure in corporate history.

Table of contents

Events Leading to the Collapse of SVB

On January 18th, Raging capital ventures posted a viral tweet thread showing signs that SVB was struggling. The thread explained how the bank’s current state will push it to either raise capital or sell its securities portfolio.

On February 23rd, Byrne Hobart, financial commentator, tweeted a snapshot of his newsletter further explaining SVB’s struggles and mentioning the unlikely scenario of a bank run.

On March 8th, SVB issued a press release stating that the bank was looking to raise capital. The reason given was that the bank suffered losses in the amount of 1.8B$, from the sales of US treasuries and mortgage securities.

On March 9th, the largest bank run in history began. A bank run happens when customers lose faith in their bank to keep their money safe. As a result, large numbers of customers rush to withdraw their deposits, either online or directly at the bank.

On March 10th, SVB officially collapses and the FIDC takes over.

Since the first Twitter warning to SVB’s public announcement, the bank had enough time to work out an effective communication strategy if they had taken notice.

Instead, SVB remained passive online, allowing social chatter to pile up.

Did Twitter Fuel the Bank Run?

As the saying goes, the world never hangs on one single hook.

In the case of the SVB bank run in March 2023, the bank’s passivity in intercepting signals about its health and injecting itself into online conversations is part of the reason.

The other reason is the high level of digitalization of bank services nowadays.

It takes less than a minute from when one reads a tweet about a possible problem at the servicing bank, to log into the online banking system and transfer all available funds elsewhere. Irrespective of the bank’s working times.

Contrary to the olden days, when digitalization was non-existent or scarce, people had to queue at the bank to withdraw their money, which they would eventually be able to do during working hours only. People knew a bank run was happening when they saw long lines of people standing outside the banks.

Today, a bank could collapse silently and discretely. If there is vitriol, frustration, anger, screaming, wailing and cursing – they all are happening on some digital platform.

This is probably why Patrick McHenry, a US representative, described the SVB’s bank run as “the first Twitter-fueled bank run.”

Given how widespread and influential social media is today, it doesn’t take much to rally people for a common goal.

Even though Twitter activity surrounding SVB was negligible for weeks, enough people hinted that something was coming.

SVB goes public

By the time SVB announced its struggles to the public, people had already heard rumors that the bank was in trouble.

At that time what people needed to hear was the bank addressing those rumors themselves on Twitter, where they were spreading.

The bank’s public press release, weeks after the initial signals, served to confirm these rumors. Unleashing a shocking chain of events.

The same day, VCs began urging their tech companies to pull their money out of the bank, eventually causing the colossal bank run.

Except in the case of SVB, the bank run turned into a sprint.

Michael Imerman, a professor at the Paul Merage School of Business at the University of California-Irvine, says that what happened to SVB was, “a bank sprint, not a bank run, and social media played a central role in that.”

In less than 24 hours, 25% of deposits had been withdrawn, amounting to $42 billion. This put SVB in a negative cash flow of almost $1 billion and plummeted its stock by 60%.

Why Social Media Intelligence Adequacy Is Crucial for Financial Institutions

Social media platforms are places where signals that might collapse a financial institution are born. As we pointed out earlier – it takes only a minute for people to see something troubling on Twitter, log in to their online banking systems, and in a panic, transfer their money elsewhere.

A bank cannot prevent a signal from happening on social media. But it must be the first one to react to it. This happens only if the bank is adequately equipped with the proper technology and protocols to handle such signals.

Social listening tools like Sensika allow you to keep track of conversations online, evaluate impact and deep dive to understand root-causes. Multi-dimensional alerts will keep your comms team on top of the chatter that is relevant to your bank – what influential people are saying about your bank, and how they are reacting to news about your bank.

Such a solution has the potential to save your institution from going down the same path as SVB.

Not only did SVB choose to remain quiet about the circulating discussions online, but it also failed to explain its situation to its customers and allowed online chatter to fill the void. Customers were kept in the dark and this caused their trust in the bank to shudder.

Even when Greg Becker, CEO of SVB, held calls with venture capital investors urging them to “stay calm”, his efforts backfired. Instead of calming people down, distrust grew further and people completely lost faith in the bank.

Why was that? Because he addressed the shareholders – the people owning the bank, but not the clients – the people keeping their money in the bank. The latter were looking at Twitter for signals to inform their decisions.

That was a phenomenal mistake, as Mr. Becker didn’t pour water, where the fire was kindling – on Twitter. He did it in a completely different place.

He seemed to have worried more about the shareholders running away, but forgot that the bigger risk for a bank is when the clients start running away with their money.

As a result, the 40-year-old reputation SVB had built over the years, shattered in hours.

Paul Donovan, chief economist at UBS Global Wealth Management told CNBC “What social media has done is increase the importance of reputation, perhaps exponentially, and that’s part of this problem I think,”

In uncertain moments, clear and timely communication drives confidence.

Takeaways

- Consumers will always be fearful of institutions being in control of their possessions, especially when it comes to their finances. Nowadays, switching banks takes a few clicks.

- No one can stop a harmful or unfavorable signal from becoming public. However, one can be the first to know about it and take immediate and necessary action.

- In situations like these, speed of reaction is essential. As signals might happen at any time, a financial institution must listen and be ready to react at any time.

This is why, with the right external intelligence tool; powerful, highly configurable, and specialized, financial institutions are in a position to reduce or even eliminate these risks.

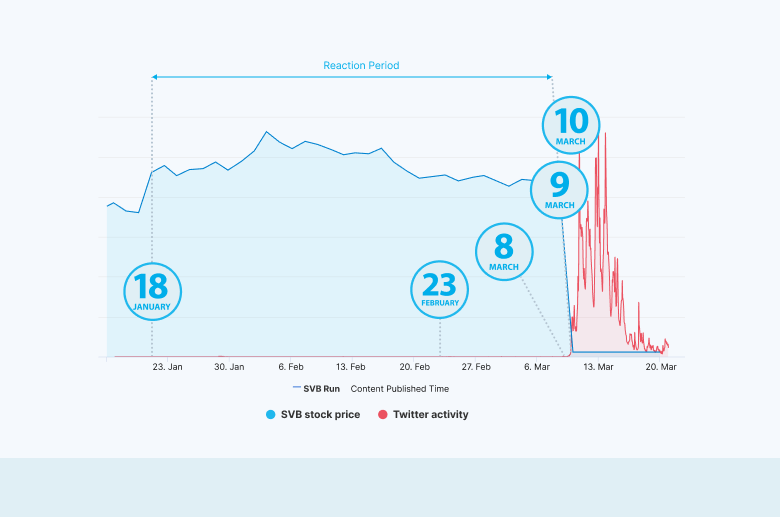

Looking at this chart, we see that the SVB communication team had a luxurious 49 days (the Reaction Period) to position the bank against a run, to reassure investors, but most importantly – its clients.

The data clearly shows that the Twitter hysteria didn’t cause the SVB share price to plummet – the press release did. Yet, the unleashed Twitter storm clearly contributed to people withdrawing their money in panic and thus – collapsing the bank.

If you are a communication or marketing professional at a financial institution, bank, insurance, leasing company, hedge or investment fund, your highest duty in these ultra-fast times is to be the first one to receive and analyze all relevant signals related to your institution.

Sensika is here to equip you for that critical job. Book a demo now.