Tesla’s much-anticipated robotaxi launch in Austin attracted global headlines, intense investor interest, and a flood of social media reactions. This rollout became a real-time case study in how quickly a positive story can shift and how public sentiment online, tracked through real-time media monitoring, correlates with visible market movements.

Using Sensika’s real-time media monitoring capabilities, we tracked more than 600 social and online posts from June 22 through June 27. Posts were grouped into intervals to reveal the speed at which narratives build, shift direction, and start influencing broader discussions and stock trends. This data-driven approach demonstrates how real-time media monitoring helps brands and investors understand the early signals that often foreshadow significant market shifts.

A Week of Rapid Sentiment Shifts

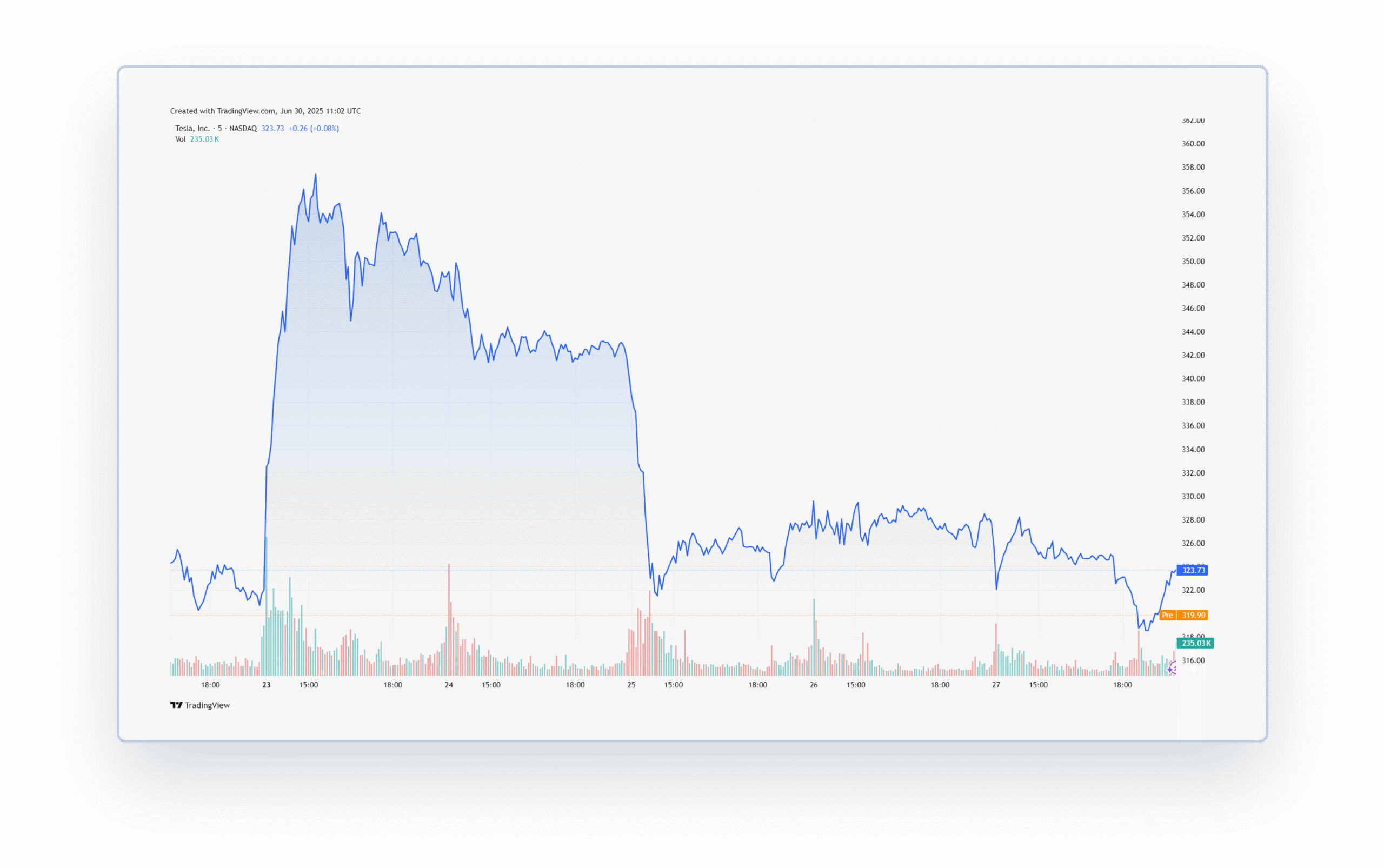

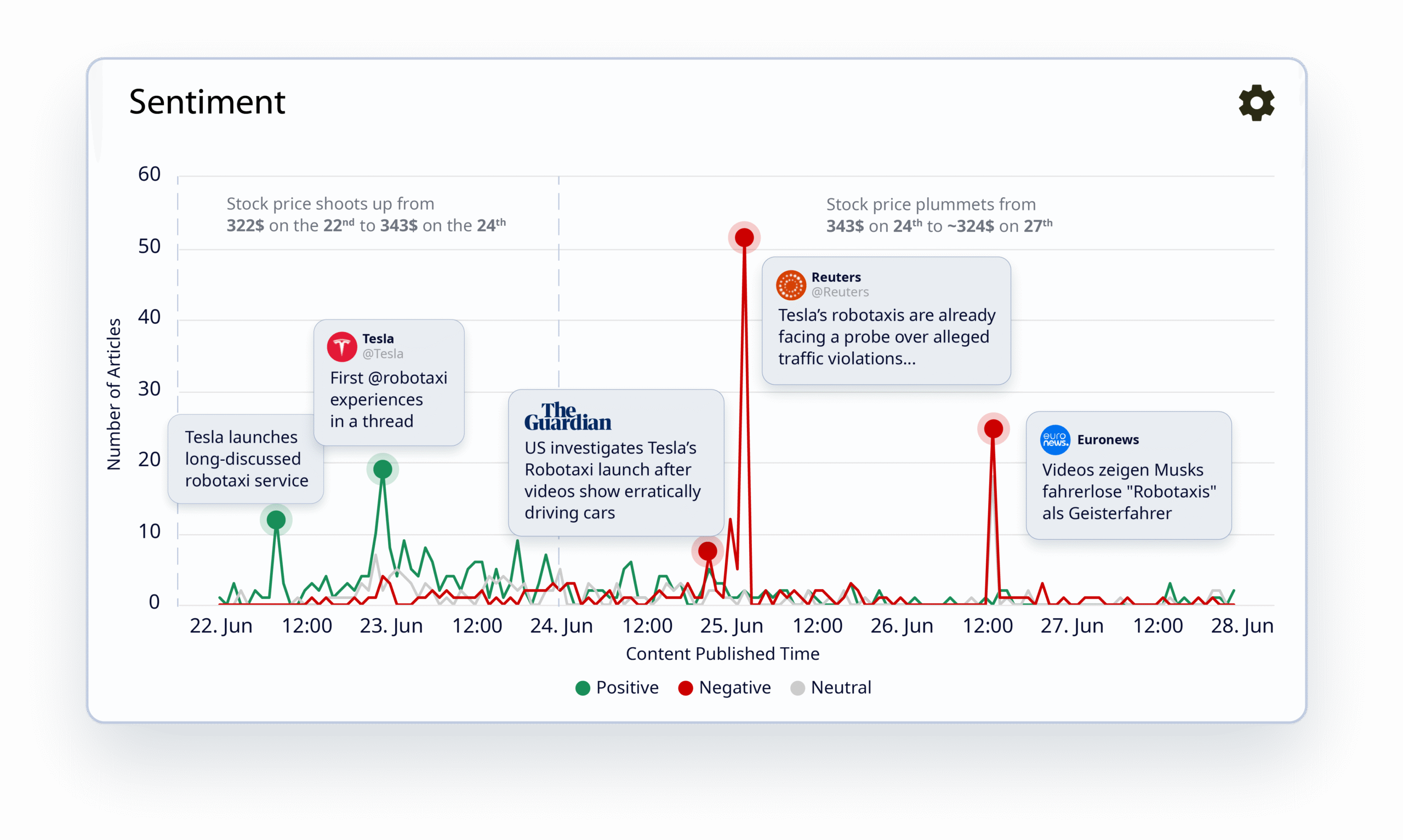

Coverage momentum accelerated quickly starting June 22, as early stories and videos framed Tesla’s robotaxi launch as a major milestone for autonomous driving technology. Influential tech outlets, bloggers, and social media influencers widely shared rollout footage, boosting optimism and driving Tesla’s share price from about $322 to roughly $343 — an increase of approximately 6.5% in just two days.

However, by June 25, the narrative pivoted sharply. Viral videos began circulating that highlighted technical glitches and safety concerns. Credible outlets like Reuters amplified these worries by reporting on potential federal investigations.

By June 27, negative sentiment dominated the conversation, and Tesla’s stock had dropped back to about $324 — reflecting a decline of nearly 4.7% from the local peak. This shift underscores how digital narratives, when tracked in real time, align closely with sudden market corrections.

Detailed Timeline Snapshot

The above chart clearly illustrates the sharp climb and the drop: the stock surges sharply on the 23rd, peaks, then dips quickly around the 25th when negative sentiment gains traction. This visual can validate the timeline and percentage changes shown in the table and chart below.

| Date Range | Stock Trend | % Change | Media Tone | Key Narrative |

|---|---|---|---|---|

| June 22–24 | ~$322 → ~$343 | +6.5% | Positive | Excitement, innovation, viral fan videos |

| June 24–27 | ~$343 → ~$324 | -4.7% | Negative | Safety fears, regulator concerns, viral criticism |

| June 27+ | ~$324 (stable) | — | Ongoing caution | Evolving story, further probes |

Key Drivers of the Sentiment Swing

What triggered this sudden narrative reversal?

Sensika’s monitoring pinpointed clear signals that amplified the shift in sentiment and directly contributed to Tesla’s stock decline.

A series of articles, including coverage from The Guardian, highlighted that Tesla’s robotaxis were under investigation for erratic driving.

Trusted news outlets such as Reuters confirmed that the US National Highway Traffic Safety Administration (NHTSA) was reviewing the robotaxi’s safety compliance. The official framing of “Tesla robotaxi safety under US investigation” gave the story credibility and expanded its reach beyond social media circles.

High-authority media published articles questioning the viability of Tesla’s timeline for deploying fully autonomous vehicles at scale. These blogs linked technical flaws with real investor concerns, adding depth to the debate and driving engagement.

This wave of negative attention fueled a clear drop in Tesla’s share price, demonstrating how quickly online sentiment can translate into market movement when trusted voices validate emerging concerns.

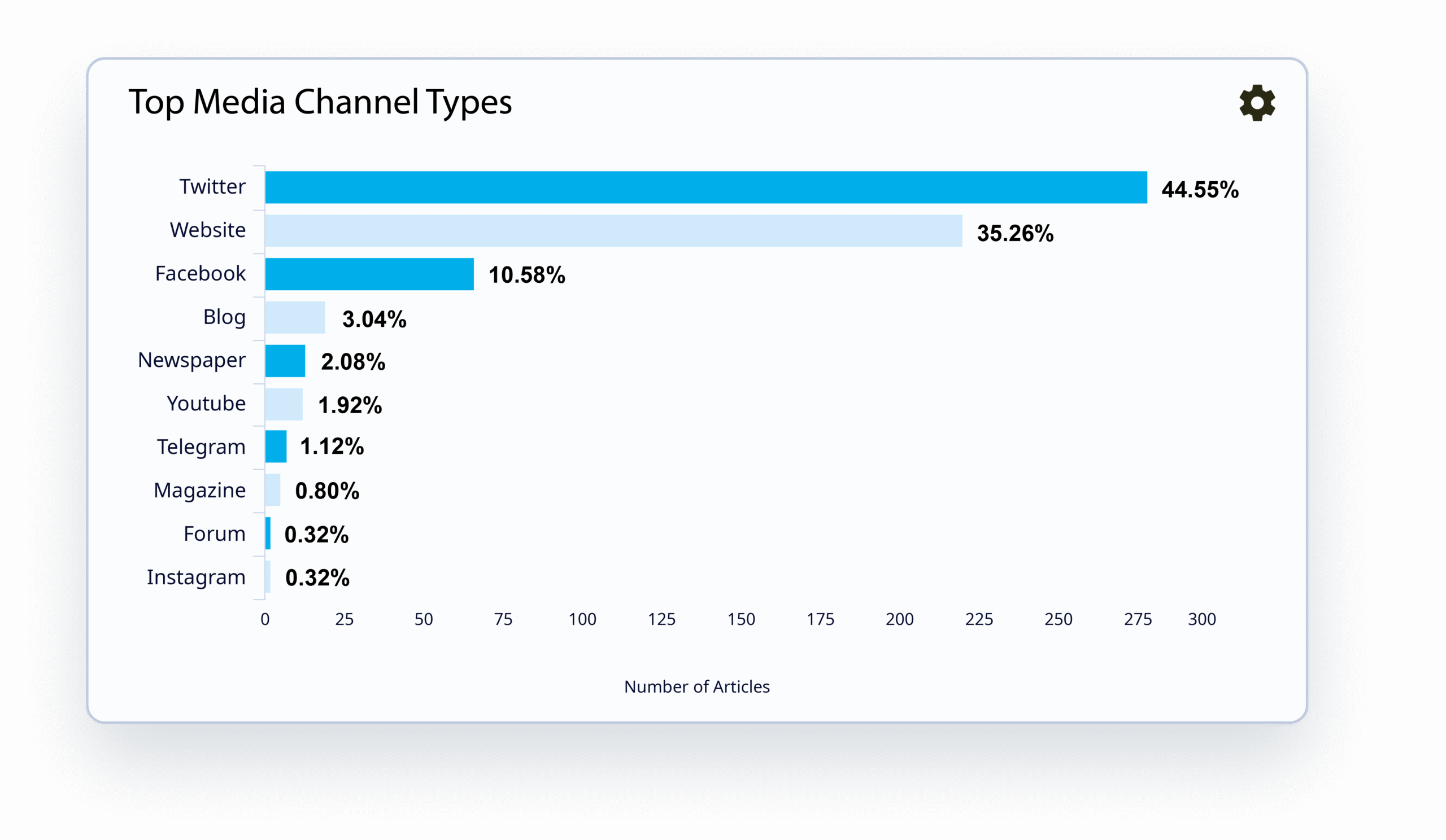

Top Platforms Driving the Conversation

Different platforms played distinct roles in shaping how the robotaxi story evolved and spread worldwide.

- X: Provided the fastest route for viral video clips, live reactions, expert threads, and breaking updates about potential regulatory reviews. Real-time conversations and influential reposts made X the core hub for immediate impact.

- YouTube: Enabled in-depth breakdowns where auto industry analysts, technology reviewers, and safety experts shared long-form commentary. Detailed video explainers helped viewers understand the technical aspects and potential implications for Tesla’s plans.

- Online Media: A wide range of blogs, digital news portals, and mainstream outlets published articles that examined the facts, gave the story wider visibility, and added credibility to the safety concerns already circulating on social media. Their coverage also helped the story cross from niche tech circles into mainstream financial and automotive news streams.

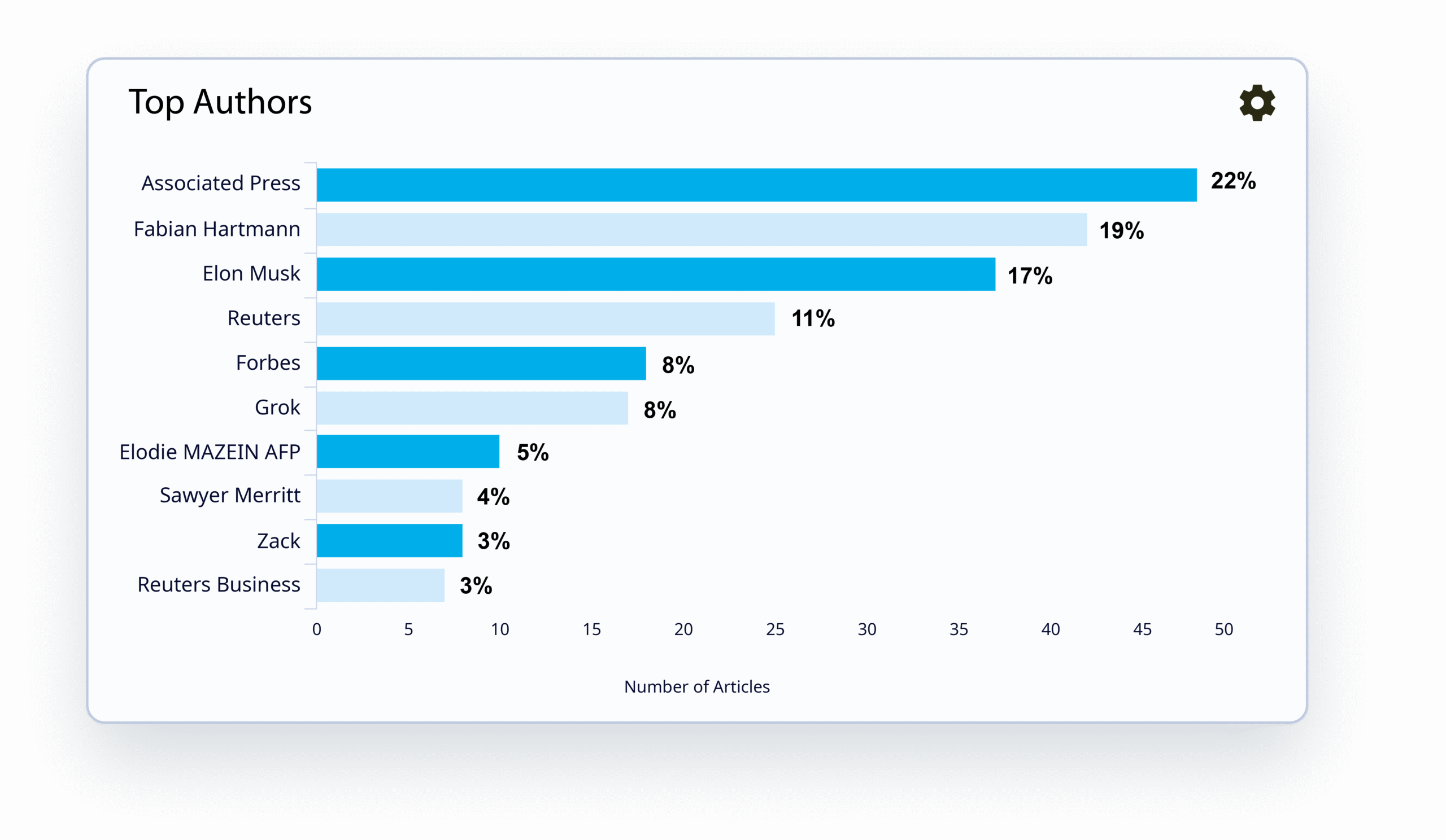

Key Amplifiers and Influencers

The robotaxi story’s reach was amplified by highly visible posts that rapidly gained traction. Verified news accounts, high-profile auto analysts, and influential blogs acted as amplifiers, extending the reach well beyond Tesla’s usual follower base. Notably, peak negative sentiment clustered between June 24 and June 27, aligning directly with the steepest drop in Tesla’s stock price. This shows how high-engagement posts can become clear signals of potential market impact.

How Real-Time Signals Guide Smarter Decisions

Sensika’s real-time media monitoring shows that narrative shifts can shape investor confidence, brand trust, and even regulatory scrutiny. But the value lies in how organizations use these insights to make informed, timely decisions that protect and grow their market position.

Real-time sentiment signals enable companies to:

- Detect risks early: Flag posts that could escalate into crises before they reach mainstream coverage.

- Understand narrative sources: Identify influential voices driving the story and predict how messages will spread.

- Quantify financial exposure: Link spikes in online discussion directly to potential stock price impact and investor reactions.

- Guide communications: Equip communications teams with clear context to respond proactively with statements or media outreach.

- Adapt operations: Adjust rollout plans, product updates, or public commitments in response to emerging public feedback.

- Support investor relations: Share timely, data-backed updates with shareholders to maintain transparency and reduce speculation.

By turning real-time media monitoring into concrete actions, brands gain the confidence to handle reputation risks, fine-tune messaging, and make agile decisions that support both market stability and long-term trust.

Protecting Brand Value with Real-Time Media Monitoring

For innovative companies like Tesla, a highly anticipated launch such as this is a real-time test of how quickly reputation can shift. Just one viral clip can trigger a narrative that reshapes public confidence overnight. Sensika’s live dashboards, AI-driven alerts, and precise timeline breakdowns show how real-time media monitoring keeps brands ahead of emerging risks and helps adjust messaging when it matters most.

Practical Next Steps for Brands and Investors

- Continuously monitor daily and hourly sentiment shifts to detect sudden changes.

- Identify the top amplifiers and communities shaping public debate around emerging issues.

- Break down conversation themes by safety, technology performance, leadership, or legal concerns.

- Produce detailed, shareable reports to support cross-team alignment, compliance updates, and investor briefings.

- Turn these insights into clear actions that protect brand trust and maintain market confidence.

Final Takeaway

Tesla’s robotaxi rollout demonstrates the undeniable link between real-time public sentiment and measurable market impact. With Sensika’s real-time media monitoring, businesses can turn media signals into proactive moves that protect their reputation and financial standing.

Ready to see this in action? Book your Sensika demo today.